BUSINESS NEWS

5 things to know before the stock market opens August 12, 2019

[ad_1]

1. Dow set to open nearly 200 points lower on trade-war concerns

Trader Thomas Lee works on the floor of the New York Stock Exchange, Monday, Aug. 5, 2019.

Richard Drew | AP

U.S. stock futures were pointing to nearly 200-point decline in the Dow Jones Industrial Average at the Wall Street open Monday. The U.S.-China trade war and concerns about slowing economic growth led the Dow, S&P 500 and Nasdaq to two weeks of losses, putting August on pace to post only the second monthly loss of 2019. China’s central bank set its currency weaker than the 7-yuan-per-dollar level for the third straight session, seen by the Trump administration as currency manipulation to mitigate the impact of tariffs.

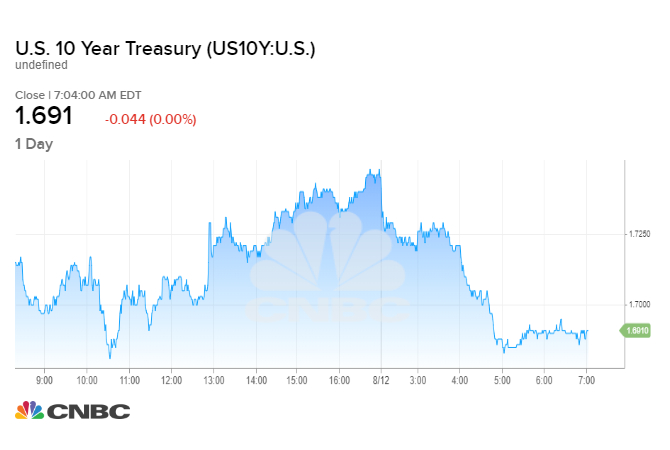

2. 10-year Treasury yield falls back below 1.7%

The exodus from stocks into bonds pushed the 10-year Treasury yield, which moves inversely to price, back under 1.7% on Monday morning. As the perceived safety of bonds continues, President Donald Trump shows no sign of backing down on trade. On Friday, he said he was not ready to make a deal with China and called into question the next round of trade negotiations scheduled for early next month.

3. Goldman Sachs lowers US economic growth estimate

President Donald Trump meets with China’s President Xi Jinping at the start of their bilateral meeting at the G20 leaders summit in Osaka, Japan, June 29, 2019.

Kevin Lemarque | Reuters

Goldman Sachs said the intractable trade war between Washington and Beijing will negatively affect the U.S. economy more than originally thought. Goldman lowered its fourth-quarter growth forecast by 0.2% to 1.8%, with the cumulative drag on U.S. gross domestic product of 0.6%. Goldman also expects the planned U.S. tariffs on the rest of China’s imports to go into effect next month, and it no longer sees a trade deal before the 2020 election.

4. Anti-government protests in Hong Kong lead to mass flight cancellations

Protesters occupy the departure hall of the Hong Kong International Airport during a demonstration on August 12, 2019 in Hong Kong, China.

Anthony Kwan/Getty Images

The increasingly violent protests in Hong Kong against the Chinese government are plunging the Asian financial hub into its most serious crisis in decades. Hong Kong International Airport, one of the world’s busiest, has canceled all departures for the remainder of the day, citing serious disruption due to anti-government demonstrations. The protests, which began in June in opposition to a bill allowing extradition to mainland China, have morphed into a democracy movement. Hundreds of demonstrators have been detained since the unrest started.

5. BlackRock buys a major stake in Sports Illustrated’s owner

BlackRock, the world’s biggest money manager with $6.84 trillion in assets under management, has become the largest stakeholder of the owner of Sports Illustrated. BlackRock bought roughly a 30% stake for $875 million in Authentic Brands Group, the company’s CEO officer Jamie Salter told CNBC’s Brian Sullivan. The deal values Authentic Brands, a brand management company, at around $4 billion to $4.5 billion, including debt, according to Salter. Authentic also owns Aeropostale, Juicy Couture, Herve Leger, Nine West, Spyder and Frye.

CNBC’s before the bell news roundup

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

[ad_2]

Source link