BUSINESS NEWS

Despite US-China trade tensions, retail sector could rebound

[ad_1]

Walmart, Macy’s and J.C. Penney are among the retailers set to report their second-quarter earnings this week.

But with the burden of the trade war, many investors are skeptical. President Donald Trump’s announcement that the U.S. is putting 10% tariffs on an additional $300 billion worth of Chinese goods, effective Sept. 1, could hammer the retail sector. On Tuesday, the administration delayed some of those tariffs on some electronics and clothing to Dec. 15, but that doesn’t mean the sector is out of the woods yet.

“The list of products these tariffs will hit are almost entirely consumer-oriented,” said the Retail Industry Leaders Association in a statement. “This new 10% tariff on Chinese imports is a direct hit on consumer products and family budgets, plain and simple.”

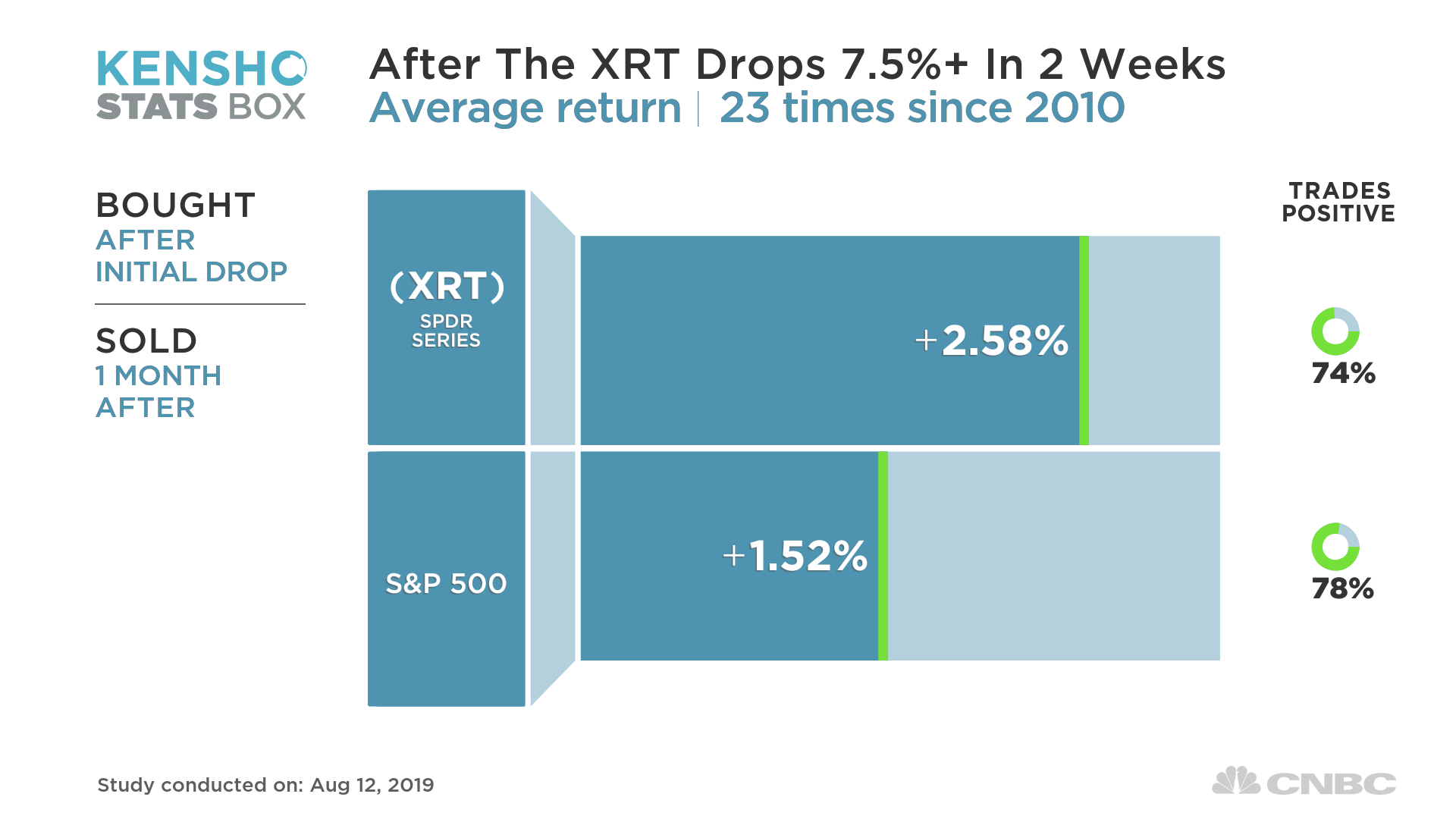

As of Monday, the SPDR Retail ETF dropped about 7.5% in the previous two weeks — hitting its lowest level of 2019.

But according to data from Kensho, a machine learning tool used by Wall Street banks and hedge funds to identify potential trades based on market history, a rebound could be ahead.

Kensho data reveals the ETF tends to reverse course — up 2.6% in one month, trading positively 74% of the time.

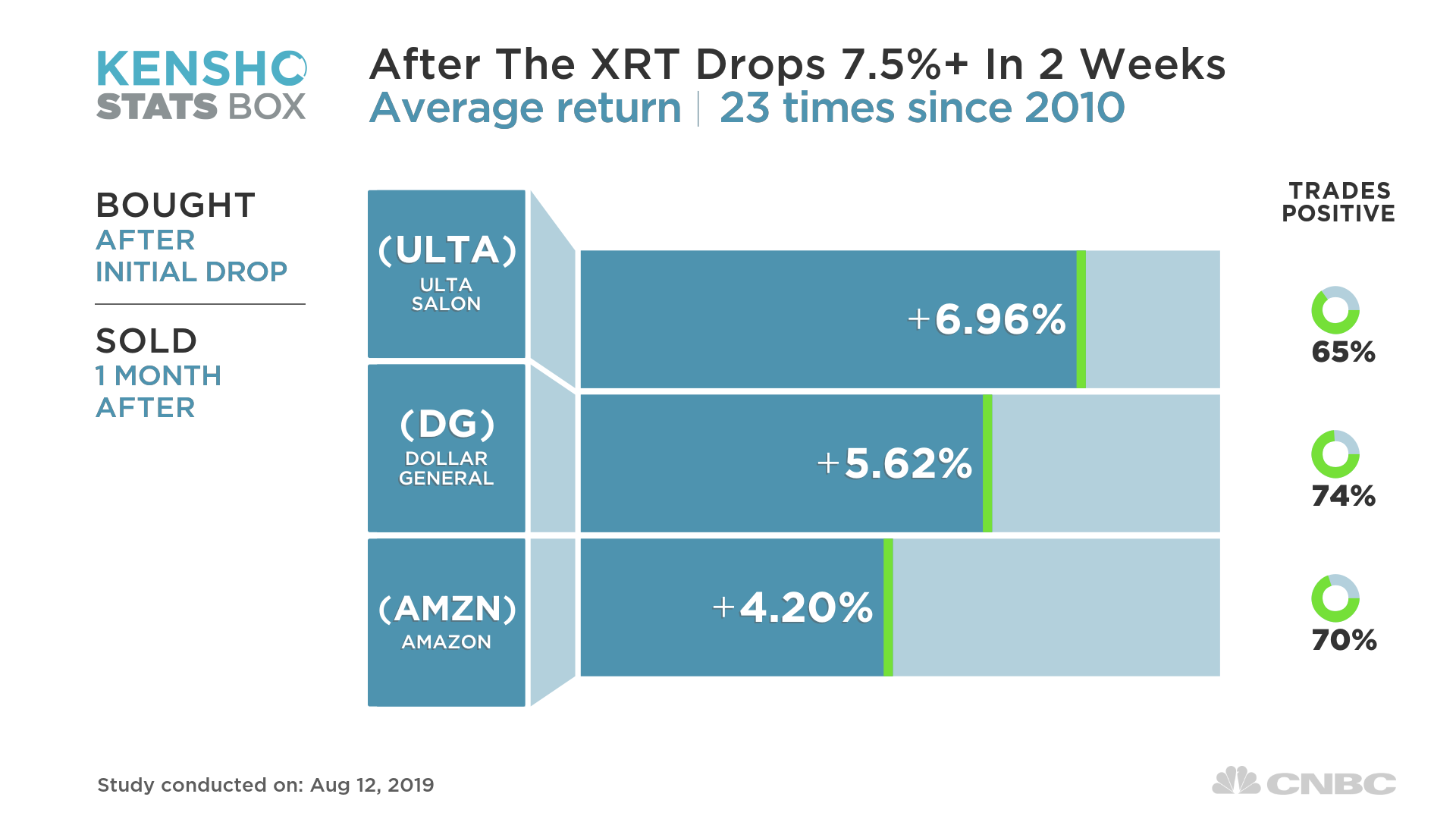

Among the stocks that tend to bounce back the hardest? Ulta Beauty, Dollar General and Amazon.

As always, past performance is no guarantee of future results. Investors should still pay close attention to commentary from management following the earnings reports.

The comeback was already playing out on Tuesday as the stocks surged on the delay in some of the tariffs.

[ad_2]

Source link