BUSINESS NEWS

Four stocks are putting up a fight against Amazon in retail

[ad_1]

Amazon, the most dominant name in shopping and retail, is facing increasing competition from a new breed of niche players in the industry, CNBC’s Jim Cramer said Tuesday.

While names like Costco, Target and Walmart have their own grip on the industry, the “Mad Money” host pointed out Etsy, LuluLemon, Pinterest and Stitch Fix as companies that are carving their own lane.

Cramer took a look at chart analysis by technician Tim Collins, one of his colleagues at RealMoney.com, to see what’s in store for the group of four companies.

“In a retail environment dominated by a handful of players that we all know … there are smaller operators that we have found ways to like and win with,” Cramer said. “The charts, as interpreted by Tim Collins, suggest that all four could have more room to run.”

Etsy

Etsy launched a new free shipping program, and the stock rose 4.45% during Tuesday’s session. The chart shows that the stock has spent the past four months digesting its 40% gains this year, which was powered by a big move in February.

“And a stock that’s spent four months consolidating … [is like] a coiled spring, which is how you get the kind of magnificent rally we had today on really very little news,” Cramer said.

Etsy is caught in an ascending triangle formation, which is a trend line that traders monitor for breakouts. In that pattern, the stock has a floor of support at $61 and a ceiling of resistance at $70, Cramer noted. It may take a number of attempts to push past $70, but Collins thinks the stock has more upside, the host said.

“You know I hate to chase stocks that have run, but when you zoom in on this chart, Collins really likes what he sees …” he said. “When it comes to Etsy, the stochastics just made what we call a bullish crossover, and that’s where the black line goes above the red one, and that is a very bullish signal that we have learned time and again in a great way to try to predict moves.”

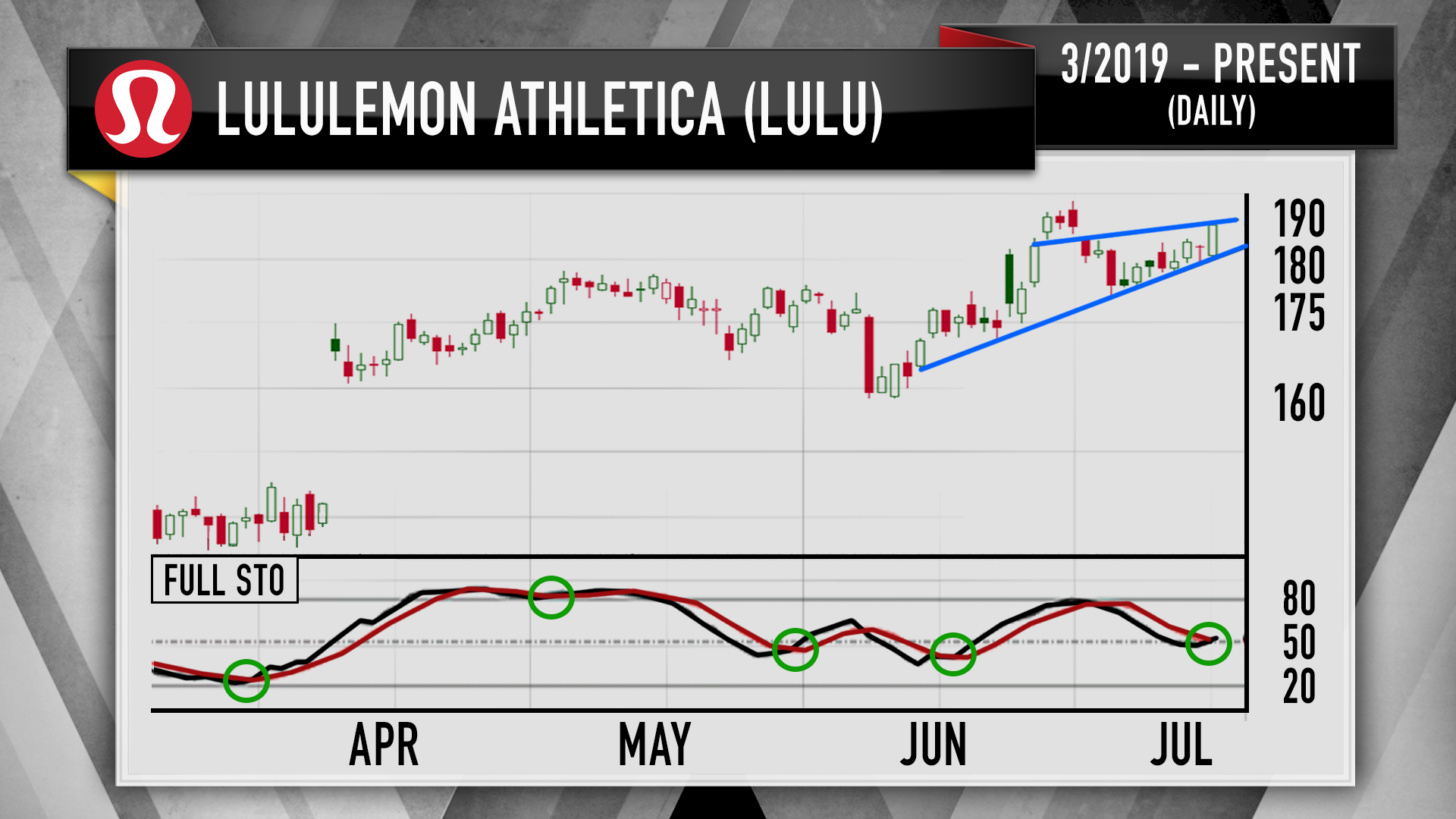

Lululemon

Collins thinks Lululemon, which posted 14% same-store sales growth in its most recent earnings report, is also digesting the gains it made after trading above $190 last month, Cramer said. The athletic apparel maker’s stock recently showed a bullish crossover indicator, which the chartist says has helped the stock run higher in the past, the host continued.

“LULU’s at $186. Collins thinks it can pole vault over $200,” he said. “However, if LULU pulls back below its floor of support at around $175 to $180, he thinks maybe you should throw in the towel, as this chart could quickly morph into a bearish head and shoulders pattern.”

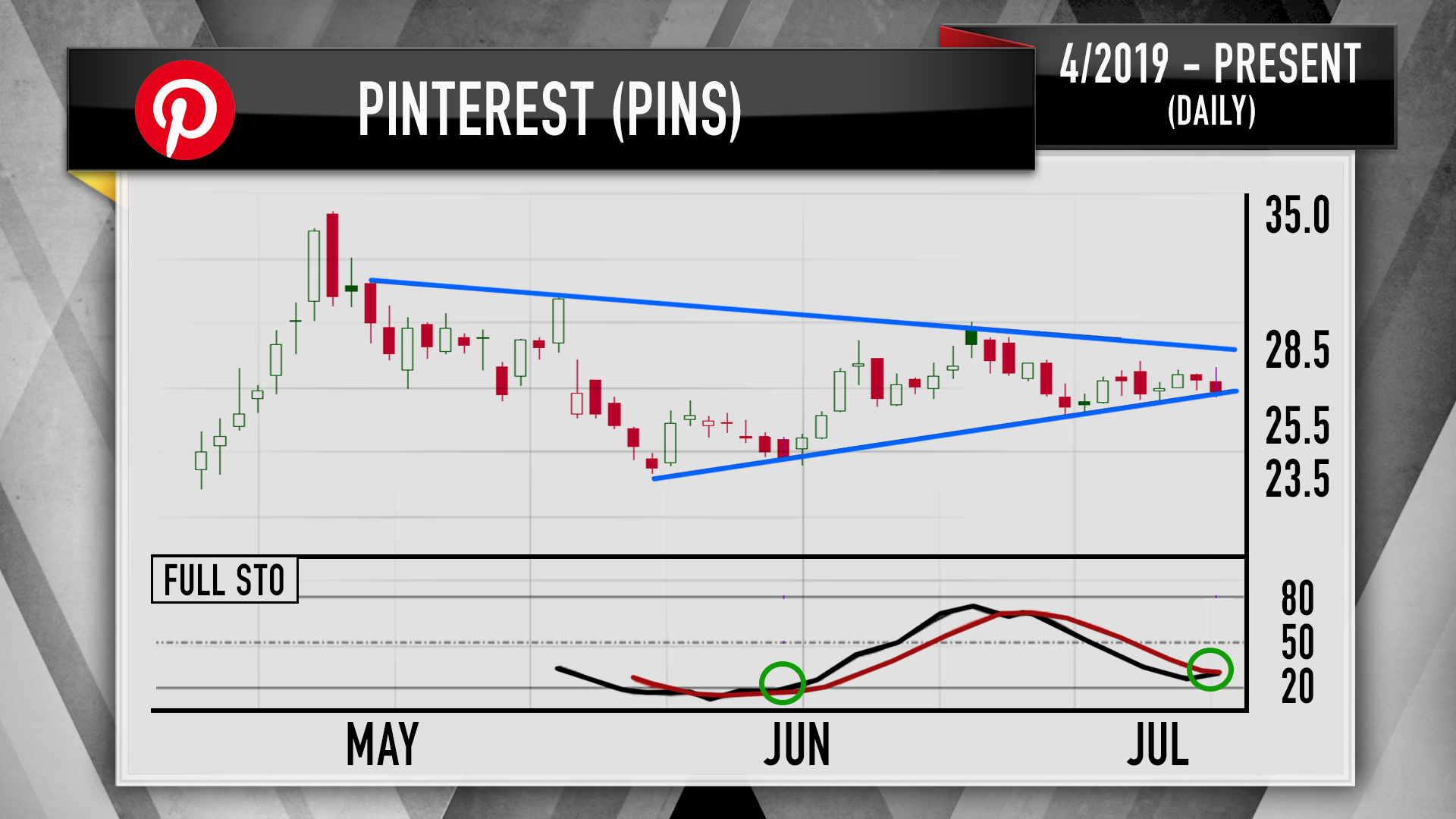

While Pinterest is not a retailer, Cramer said the vision board platform where users browse things to buy has potential to compete with Amazon in the future. The social media company went public in April and has traded within a tight range in recent weeks, he said. Shares closed Tuesday’s session more than 12% higher than its first trade on the market of $23.75 almost three months ago.

“If Pinterest can climb above $28.50, Collins believes it will be smooth sailing to the $30s,” Cramer said. However, if the stock drops below $25.50, “it might sink to $23.50. But get this: It bottomed in May. Collins says he’d be a buyer if that happens.”

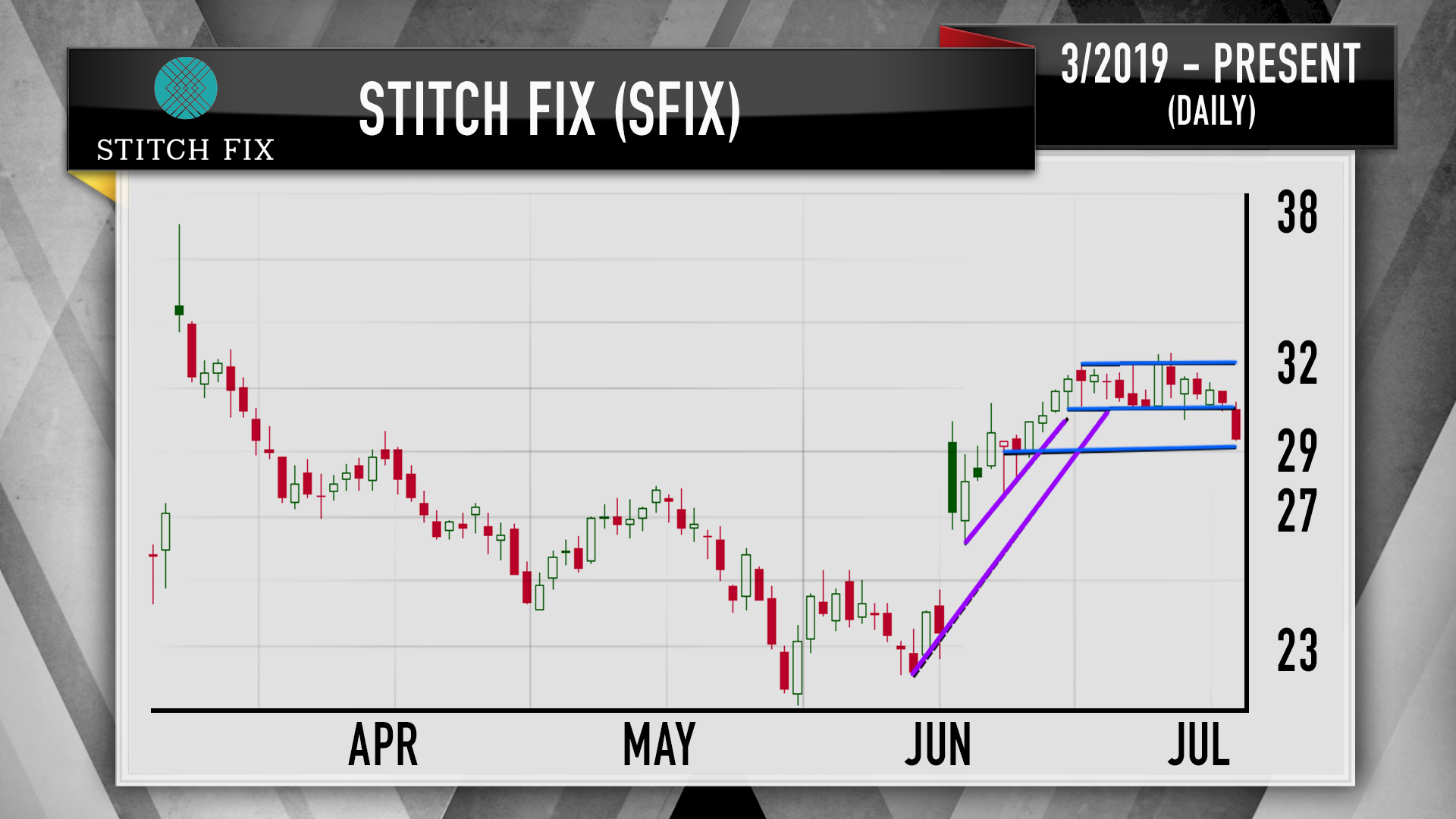

Stitch Fix

Stitch Fix, an online personal styling subscription service, has been a difficult stock to own, but the company in June reported a strong quarter that sent the stock up $4 to $27 in one session, Cramer said. Shares continued to rally before cooling off two weeks later, which produced a bullish flag pattern where a stock runs before trading sideways, he highlighted. The pattern indicates that an equity will continue its prior move.

Stitch Fix dropped 4% during Tuesday’s session, but Collins says the stock has a floor of support at $29, Cramer said. Collins thinks shares can run as high as $40 if they break through a ceiling of resistance of $32, he said.

“That’s why Collins recommends buying it right here, although bear in mind, [shares of] Stitch Fix could keep bouncing around in this flag pattern for another few weeks,” Cramer said. “He suggests buying half your position now, and then putting on the other half after a breakout above $32. I get where he’s coming from.”

Disclosure: Cramer’s charitable trust owns shares of Amazon.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

– Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com

[ad_2]

Source link