BUSINESS NEWS

Tesla’s chaotic year after Musk’s ‘funding secured’ tweet

[ad_1]

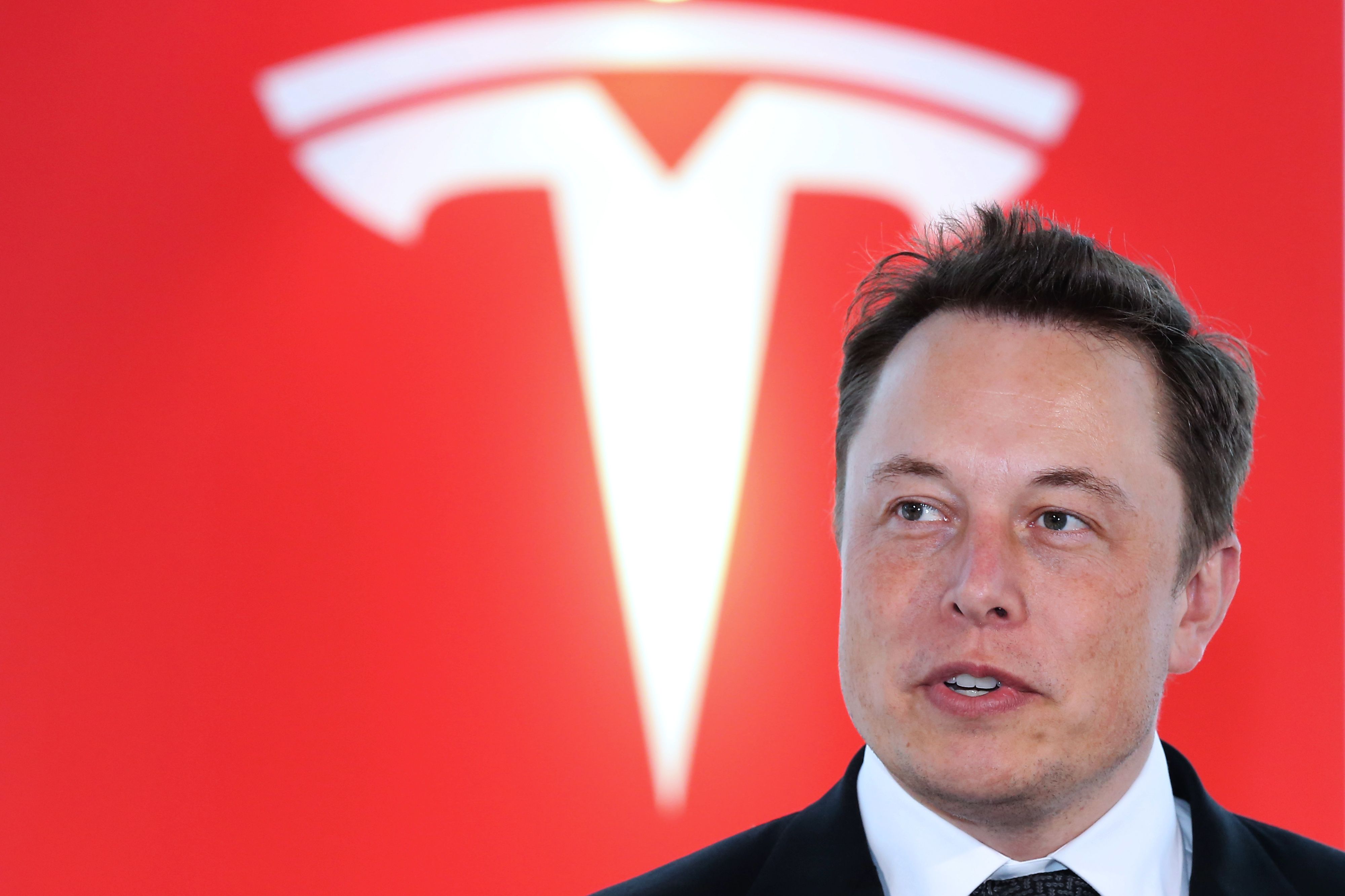

Elon Musk, co-founder and chief executive officer of Tesla Motors.

Yuriko Nakao | Bloomberg | Getty Images

A year ago, Tesla shares jumped to near-record levels as CEO Elon Musk tweeted he had “funding secured” to take the company private at $420 a share.

The now-infamous tweet on Aug. 7, 2018 marked the beginning of a chaotic 12 months for the Silicon Valley automaker that set new performance records coupled with some extreme low points, which have brought litigation, government inquiries, layoffs and operational challenges. A September settlement agreement with the Securities and Exchange Commission removed Musk from his chairman role while the company.

Neither Musk nor Tesla had to admit any wrongdoing under the settlement, but they couldn’t deny wrongdoing, either.

Tesla’s shares have tumbled 36% over the last year to a Thursday close of $238.30, wiping out roughly a third of its market value, which now stands at $42.7 billion.

Still, it’s far from all bad for Tesla. The company reported two consecutive quarterly profits for the first time ever and it significantly increased production to about 7,000 vehicles per week.

However, even many of Tesla’s positive milestones have been shrouded in controversy, including recent claims the company made on the safety of its Model 3 sedan that have been called into question by the U.S. National Highway Traffic Safety Administration.

Tesla didn’t immediately respond to requests for comment.

Here’s a look at some of the highlights, and low lights, from Tesla’s turbulent year since the “funding secured” tweet and how the market reacted:

‘Staying public’

Weeks after Musk’s initial tweet, he announced Tesla would remain a publicly traded company on Aug. 24.

Musk, in a blog post, said the decision was based on the process being “even more time-consuming and distracting than initially anticipated” and shareholders, “in a nutshell,” saying, “please don’t do this.”

Tesla’s shares fell by about 16% over those three weeks from their close of $379.57 a share the day Musk tweeted “funding secured.”

Weed and the Joe Rogan show

Musk stunned the world when the CEO smoked what appeared to be a joint on the Joe Rogan podcast during a wide-ranging interview on Sept. 6. The podcast sparked calls for his resignation and questions about his mental stability.

It also drove shares down 6.3% the next day.

SEC lawsuit

Musk was sued by the SEC on Sept. 27, causing shares of the automaker to fall more than 13% in extended trading to roughly 30% below its 52-week high of $387.46 on Aug. 7, 2018.

The SEC complaint alleged that Musk issued “false and misleading” statements and failed to properly notify regulators of material company events.

Musk called the allegations “unjustified” and said he “never compromised” his integrity.

“This unjustified action by the SEC leaves me deeply saddened and disappointed,” Musk said in a statement to CNBC. “I have always taken action in the best interests of truth, transparency and investors. Integrity is the most important value in my life and the facts will show I never compromised this in any way.”

Tesla cars are delivered to a showroom in Brooklyn, New York on April 25, 2019.

Spencer Platt | Getty Images

Settlement reached

Two days after the SEC filing, the two sides announced a settlement that included $40 million in fines and Musk giving up his role as chairman for at least three years. The fines were split evenly between Musk and Tesla.

The company’s shares jumped 17.35% the following day to $310.70 – the highest single-day gain in the past 12 months for the automaker.

‘Shortseller Enrichment Commission’

Days after settling the fraud charges against him, Musk mocked the SEC in an Oct. 4 tweet, calling the agency the “Shortseller Enrichment Commission.”

Shares of the automaker fell more than 2% after hours following the tweet, after already falling 4.4% while the markets were open.

Shares closed the following day down 7% at $261.95 per share.

‘Historic’ quarter

The company reported a surprise profit and big jump in revenue for the third quarter on Oct. 24, sending the stock soaring by more than 12%.

Musk told analysts on a call it was an “incredibly historic quarter” for the company, which was still working on ramping-up production of the Model 3 sedan.

New chair

Tesla board member Robyn Denholm, the former COO and CFO at Australian telecom company Telstra, was named to replace Musk as chairperson of the company on Nov. 7.

Tesla shares closed the following day slightly up to $351.40 per share.

Robyn Denholm

Source: Telstra

China

Musk and Shanghai Mayor Ying Yong on Jan. 6 celebrated the groundbreaking of the electric automaker’s first non-U.S. factory on the outskirts of Shanghai.

Producing vehicles in China is expected to reduce costs from tariffs and ocean transport for Tesla.

According to the company, the so-called Gigafactory in Shanghai “will allow Tesla to localize production of Model 3 and future models sold in China, with plans to eventually produce approximately 3,000 Model 3 vehicles per week in the initial phase and to ramp up to 500,000 vehicles per year when fully operational (subject to local factors including regulatory approval and supply chain constraints).”

Tesla CEO Elon Musk speaks during a meeting with Chinese Premier Li Keqiang (not pictured) at the Zhongnanhai leadership compound in Beijing on January 9, 2019.

MARK SCHIEFELBEIN | AFP | Getty Images

Layoffs

In January, Tesla said it would cut 7% of its workforce.

In a Jan. 18 email to employees, Musk said the company faces a “very difficult” road ahead in its long-term goal to sell affordable renewable energy products, noting the company is younger than other players in the industry.

The January layoffs impacted at least 1,017 California employees, according to the company’s filings with the state’s Employment Development Department

Shares of the company fell 13% to $302.26 per share after Musk’s email was reported.

Another profit

SEC-Musk: Round 2

Musk’s deal with the SEC appeared to be in jeopardy when it asked a judge on Feb. 25 to hold Elon Musk in contempt for violating its settlement deal.

The SEC cited an “inaccurate” Feb. 19 tweet about vehicle production. On that date, Musk tweeted — then revised — projections for full-year Tesla manufacturing numbers of “around” 50,000 units.

After months of back-and-forth, the SEC and Musk reached an agreement over the use of his use of Twitter account. It detailed exactly what kind of information requires formal legal review before being shared.

Credits into cash

Tesla has made over $1 billion in the last three years by selling emissions credits in the United States, including a reported deal in April with Fiat Chrysler. The Italian-U.S. carmaker agreed to pay Tesla hundreds of millions of euros to allow Tesla vehicles to be counted in its fleet to avoid fines for violating new European Union emission rules.

The reported deal did little to move the company’s shares, which were trading around $270 a share at the time.

Below $200 a share

Tesla stock dipped below $200 a share in late-May as Morgan Stanley auto analyst Adam Jonas cut the firm’s worst-case forecast on Tesla’s stock from $97 a share to just $10, citing concerns about the company’s increased debt load and geopolitical exposure.

Other analysts lowered their expectations, including Goldman Sachs, which slashed its price target a month later on concerns about demand for Tesla vehicles. UBS’ Colin Langan also cut his price target by 20% in June to $160 a share and reiterated his sell rating.

The concerns followed several changes to Tesla’s business plans, including an announcement to shift to an online sales model that would result in many store closings and price cuts.

Tesla stock hit its lowest closing price in two and a half years on June 3 at $178.97 per share.

NHTSA cease-and-desist

The National Highway Traffic Safety Administration sent Musk a cease-and-desist letter in October regarding “misleading statements” made in a blog post that month about the Model 3 having “the lowest probability of injury of all cars the safety agency has ever tested.”

The NHTSA, which awarded the Model 3 an overall 5-star safety rating for the 2017 model, said it referred the matter to the Federal Trade Commission’s Bureau of Consumer Protection, according to a copy of the letter, which was posted earlier this week on the legal transparency website PlainSite.

Visitors look at a Tesla Model 3 during a press preview of the Seoul Motor Show in Goyang, northwest of Seoul, on March 28, 2019.

Jung Yeon-Je | AFP | Getty Images

Rebound

Tesla shares had rebounded in recent months to more than $260 per share before it missed second-quarter earnings estimates on July 24, sending shares tumbling more than 13% the next day.

While discussing the earnings, many were surprised to hear that Tesla Chief Technology Officer JB Straubel, a co-founder of the company, would be leaving his post to become an advisor to the carmaker — adding to a growing list of executive turnover at Tesla.

CNBC’s Lora Kolodny contributed to this article.

[ad_2]

Source link