BUSINESS NEWS

The yield curve everyone’s worried about nears a recession signal

[ad_1]

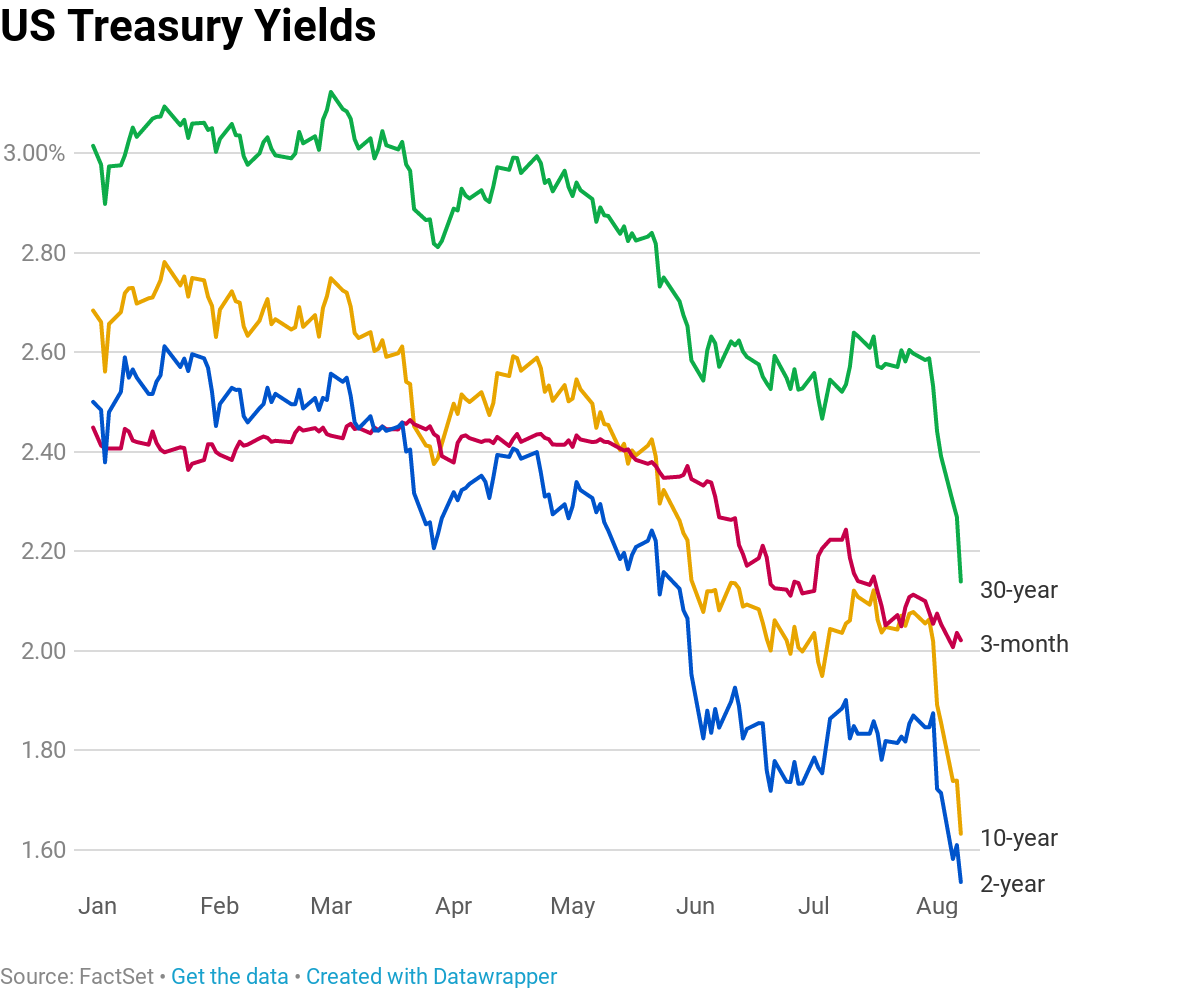

The dramatic scramble for U.S. debt as a safe haven has pushed a bond market recession indicator inches away from the warning zone.

The Treasury yield curve — the obscure plot of U.S. interest rates based on maturity dates — is sloping even more downward and threatening to send 10-year rates below 2-year rates.

The yield on the 10-year Treasury note — an important rate banks use when setting mortgage rates and other lending — is in free fall, plunging more than 40 basis points over the last month.

But the 2-year rate, more sensitive to changes in Federal Reserve policy, hasn’t fallen as much and has been kept in check after the central bank suggested it may not cut rates as fast as some had hoped.

That has narrowed the relative return long-term investors enjoy for lending to the U.S. government over the long term. In fact, loaning to Uncle Sam for 10 years only earns a long-term bond investor 1.76%, just 13 basis points — or 0.13 percentage points — above the expected return on the much-shorter 2-year Treasury note, currently trading at 1.63%.

To be sure, portions of the yield curve have been inverted for months, with the rate on the 3-month Treasury bill first rising above that of the 10-year note in March. Any such inversion tends to signal lower growth and inflation, as well as bad credit in the near-term.

But despite the early signal, many fixed-income investors opted to wait for an inversion of the 2-year and 10-year note yields, seen by many as the more meaningful indicator. Investors often give the spread between the 10-year and the 2-year special attention because inversions of that part of the curve have preceded every recession over the past 40 years.

Historical inversions of the 10-2 spread, recessions in gray

.1565198110128.png)

Source: Federal Reserve Bank of St. Louis

While abstract and largely ignored during times of economic health, the yield curve is normally represented by an upward-sloping line, illustrating the increasing amount the U.S. government doles out to bondholders in tandem with how long they’re willing to loan Washington cash. However, its usual upward shape can flatten or invert when investors think economic growth is likely to fall.

And while an economic downturn wasn’t as obvious in late 2018, investors now appear more certain that U.S. growth could be set for a slump following two critical policy errors, according to Mark Cabana, head of U.S. short-rate strategy at Bank of America Merrill Lynch.

The combination of an intensifying U.S.-China trade war and a less-sympathetic Fed are convincing investors that a downturn is more likely, boosting demand for long-term bonds.

“On trade, obviously the escalation isn’t good for global growth, and the longer it persists, the worse it is for the global economic backdrop,” Cabana told CNBC. “The Fed isn’t getting ahead of this enough. They characterized their rate cut as a ‘midcycle adjustment’ … that clearly isn’t what the market feels is necessary.”

To be sure, while every recession in the modern era has been foretold by an inversion, there have been a few “false alarms” along the way.

“It doesn’t mean you will have a recession. It does not bring about recession,” Cabana said. “But it clearly shows there’s more demand on the long end. It’s a harbinger of elevated recession risks.”

[ad_2]

Source link