BUSINESS NEWS

Barneys’ bankruptcy sheds a light on the New York real estate market

[ad_1]

Shoppers exit and enter a Saks Fifth Avenue store on Fifth Avenue in New York City.

Getty Images

With luxury department store chain Barneys New York filing for bankruptcy this week in the wake of a rent hike at its Madison Avenue flagship, some people have cast blame on Barneys’ landlord for pushing the retailer over the edge.

A deeper look at the Manhattan retail real estate landscape shows a complex picture.

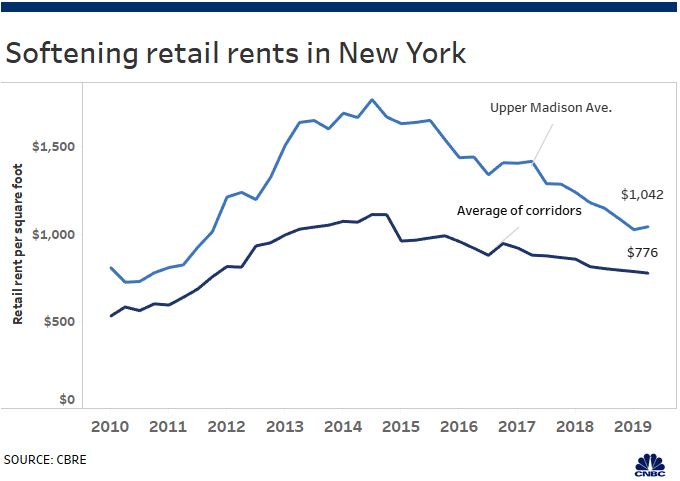

Retail rents in New York neighborhoods, or corridors, including Fifth Avenue around Grand Central, SoHo and the Upper East Side are nowhere near levels seen in a 2014 peak. Even Madison Avenue — known for its prestige in the market as a destination for high-end brands like Chanel and Dolce & Gabbana — hasn’t been immune to the trend of falling rents.

In the second quarter of 2019, average asking rents across New York City declined an average of 4.5% from a year ago to $776 per square foot, according to an analysis by commercial real estate services firm CBRE. It marked the seventh consecutive quarter of declines. Rents along Upper Madison Avenue (57th to 77th Streets) in particular dropped 11.7% from a year ago to $1,042 per square foot.

In the case of Barneys, landlord Ashkenazy Acquisition worked with a third-party arbitrator, but the rent was still doubled at its Madison Avenue flagship from roughly $16 million to about $30 million in January, despite its best efforts to halt the move, people familiar with the matter told CNBC in April. The increase nearly wiped out the retailer’s earnings before interest, taxes, depreciation and amortization, these people said at the time.

But multiple brokers and real estate executives have told CNBC Barneys was still getting a good deal on rent, at that price, for a quarter-million square-foot store that spans nine levels. Ashkenazy didn’t respond to CNBC’s request for comment.

The rent only added to other pressures Barneys faces. More shoppers are turning to online luxury platforms like Farfetch or going directly to brands to shop — all of which has eroded Barneys’ sales growth.

We’re shaking out the legacy retailers, dealing with the overhang of space … these things take time. But it doesn’t mean retail here is dead.

Steven Soutendijk

Cushman & Wakefield, executive managing director

Meantime, Barneys still plans to keep its two stores in Manhattan — it has a second one in the Chelsea neighborhood. In total, it plans on shuttering 5 of its 13 department stores, and has enough financing to fund it into October as it tries to find for a buyer for its business.

In New York, “nobody would be happy if Barneys went vacant,” said Steven Soutendijk, an executive managing director at commercial real estate services firm Cushman & Wakefield. “Barneys [on Madison Avenue] is just a huge block of space. It would take a lot of time to get it rented.”

And for Barneys, and for many other brands, Manhattan still has its prestige. The boroughs are changing to include more office spaces, residential high-rises, restaurants and e-commerce brands taking a plunge into bricks and mortar. And landlords are coming to terms with the fact that sky-high rents are no longer justified.

“We’re shaking out the legacy retailers, dealing with the overhang of space … these things take time,” Soutendijk said. “But it doesn’t mean retail here is dead.”

Still, the list of recent closures is a long one. Lord & Taylor has gone dark on Fifth Avenue, to be replaced by WeWork. Saks Fifth Avenue closed its women’s shop at Brookfield Place downtown, to be replaced by another co-working operator Convene. Macy’s is planning to build an office tower atop its location at Herald Square. Other flagships from the likes of Gap, Tommy Hilfiger and Hollister have shut across the city.

Meanwhile, dollar store Five Below opened up on Fifth Avenue last November. Old Navy is opening up on the Upper East Side. Ulta is planting a new flagship shop near Herald Square. Target is still bringing more small-format locations to Manhattan. Brands that started on the internet like Warby Parker, Outdoor Voices, Casper, Candid Co. and Indochino have shops all across the city.

And part of what’s opened the door for these companies to move into Manhattan with greater force is more flexible lease terms and cheaper rents. At some point, landlords had to budge. A lot of these new retailers aren’t going to pay higher rents, either.

“If someone was renegotiating a lease today, it’s a very different market than it was 10 or 15 years ago,” said Nicole LaRusso, director of research and analysis at CBRE.

After 2014, as rents started to fall and store closures picked up, “landlords didn’t want to hear it,” LaRusso said. “But most of that lesson has been learned now.” There’s much more negotiating being done today, she said. “I think we are getting to that equilibrium.”

‘Resiliency’

One of the biggest questions in the Manhattan commercial real estate market remains: “When will rents stop dropping?” And nobody seems to know the exact answer to that. But the pain appears to be dissipating.

CNBC spoke with three different New York-based brokerage arms that agreed the drop was leveling off and leasing activity was picking back up.

Some cited the activity downtown at Related’s Hudson Yard mall and Brookfield’s Five Manhattan West project as signs there’s still demand from retailers to open stores. New pockets of retail are emerging. All the activity isn’t centralized around Fifth Avenue and Madison Avenue, anymore.

Start-ups like shoe brand Margaux and handbag retailer Goldno.8 have flocked to Bleecker Street in the West Village. Up-and-coming athletic apparel brands like Outdoor Voices, Alo, Bandier and Sweaty Betty either have moved or are in the process of moving to Flatiron. The Meatpacking District has the glitzy new RH store and massive Starbucks Roastery.

“Meatpacking today is what I would call New York’s ‘it’ neighborhood,” said Jared Epstein, developer at Aurora Capital Associates. Epstein worked on RH’s roughly $250 million deal for a 15-year lease in the area. An RH hotel is also set to open in the Meatpacking District next fall.

In the second quarter of 2019, total leasing velocity across all New York corridors, taken in aggregate, was more than 3.8 million square feet, nearly 22% ahead of the 3.1 million square feet recorded two years ago, according to CBRE. Food-and-beverage purveyors were the most active tenants, the firm said, followed by grocery stores.

“New York has a certain resiliency that is proven time and time again,” Francis Greenburger, founder and CEO of real estate developer Time Equities. “I would never doubt New York resiliency.”

[ad_2]

Source link