BUSINESS NEWS

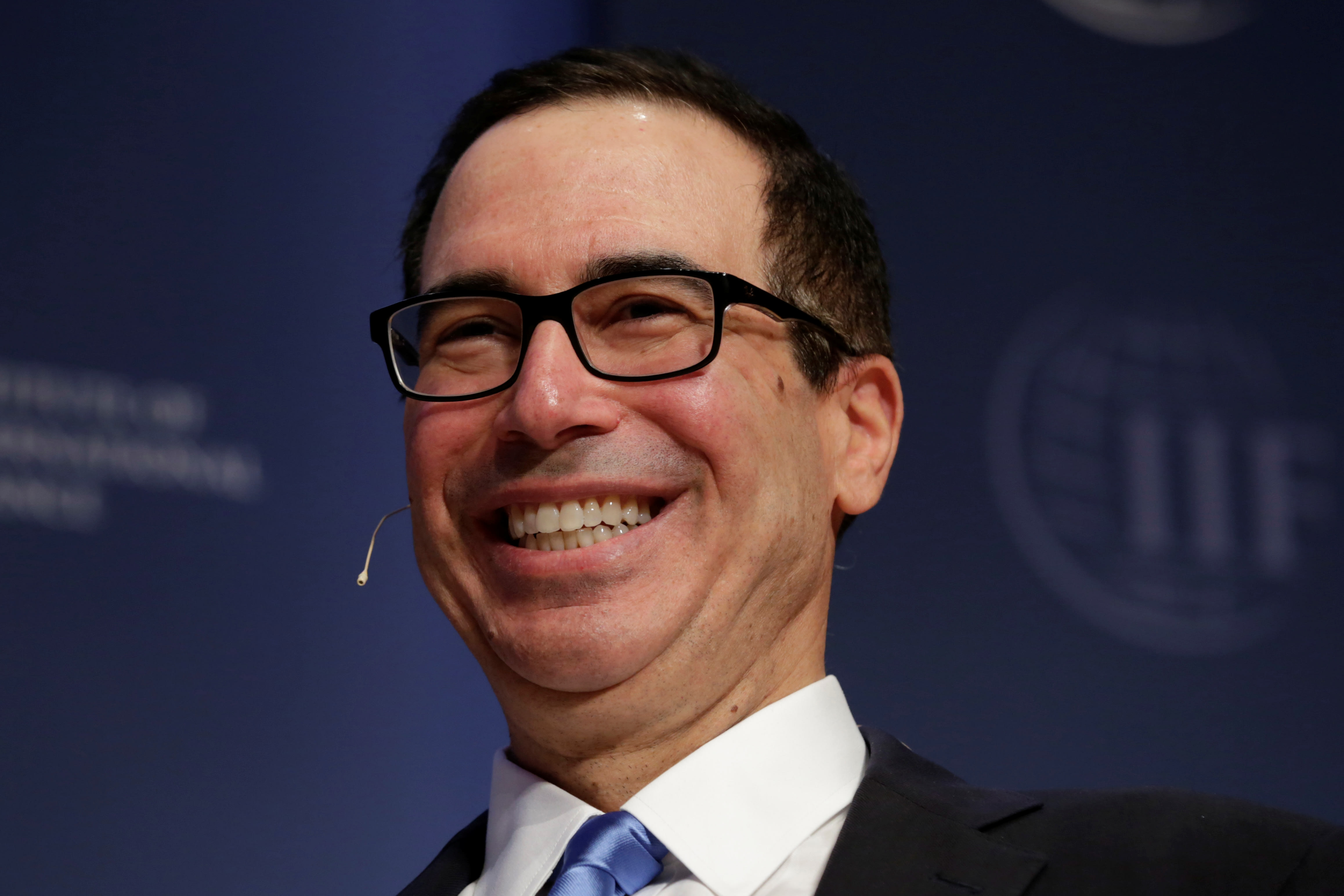

Steve Mnuchin disses 181 CEOs in new battle over future of profits

Jamie Dimon, chairman and CEO of JPMorgan Chase; Randall Stephenson, chairman and CEO of AT&T; and Dennis Muilenburg, chairman, president and CEO of Boeing participate in a 2018 event hosted by the Business Roundtable.Mark Wilson | Getty Images News | Getty ImagesTreasury Secretary Steve Mnuchin has his fair share of critics on the left and among the larger public, but last week he added close to 200 CEOs to a list of those who might have reason to hold something against him, and all it took was five words.”I wouldn’t have signed it.”With those five words, Treasury Secretary Steve Mnuchin dismissed the 181 CEOs of major corporations — including the CEOs of Amazon, American Express, Apple, Coca-Cola, J.P. Morgan, Johnson & Johnson and Procter & Gamble, even the CEO of his old Wall Street firm Goldman Sachs, and on and on, across all of the major industries in the U.S., from airlines to consumer goods, financial services, natural resources and utilities — who recently signed onto the Business Roundtable statement on the purpose of a corporation, committing to value customers, invest in employees, deal fairly with suppliers and support communities.All of those goals seem worthy, but as far as Mnuchin is concerned, signing onto these goals as part of the purpose of a corporation is all wrong.”I wouldn’t have signed, because I think it’s not a simple answer,” Mnuchin told Andrew Ross Sorkin in an interview at the DealBook DC Strategy Forum last week. “People on a lot of these issues want a one-sentence or two-sentence answer. Obviously, businesses should have a purpose, to be profitable you need to have a purpose. It’s not as simple as saying you have a purpose or profits. A simple answer does not fully explore the issues. Companies need to have a purpose and have profits.”Ross Sorkin said on CNBC’s “Squawk Box” that there was an audible “gasp” in the room when Mnuchin dismissed the Business Roundtable, but the Treasury Secretary is not alone in his skepticism. And it is not only rooted in thinking the CEOs signatures are the penned equivalent of lip service — “CEO virtue signaling” — that won’t be followed by action.The BRT has always come in for criticism from shareholders, but typically it has been for being a behind-the-scenes power player in efforts to limit activist and impact investors, and on some of the issues that matter most to employees and communities: income inequality and climate change, as examples. Regulatory efforts to restrict shareholder proposals on annual proxies related to climate reporting and CEO pay have the BRT’s fingerprints all over them, socially minded shareholders say.”Shareholders being restricted, restricted until their voice is simply silenced, that is the goal of the BRT,” said Andrew Behar, CEO of As You Sow, a nonprofit focused on environmental and social corporate responsibility through shareholder advocacy.The CEO role is changing, and the social profile of the role is more undeniable today, from the recent Walmart CEO-led stance on gun control to Amazon CEO Jeff Bezos’ announcement on Thursday that his company has set the goal of being 100% renewable energy well ahead of the timeline set by the Paris Agreement.But with the BRT statement it is a broader group of shareholders, institutional investors and corporate governance experts blasting the Business Roundtable for dredging up an old idea about corporate accountability beyond shareholders that already proved it is bound to end badly.Some are downright angry.”Good for Mnuchin,” said Charles Elson, who heads the Weinberg Center for Corporate Governance at the University of Delaware and has served on multiple corporate boards, including the current board of Encompass Health. “Did any of these CEOs ever contact the board about signing it? … There is no way boards would have approved it, because it is shareholders who elect boards, who hire the CEO.”Elson said talk among his fellow board members at Encompass Health was “highly negative.”Putting shareholders last and calling them ‘suppliers of capital’ is kind of like calling parents genetic suppliers to existence.Charles ElsonWeinberg Center for Corporate Governance at the University of DelawareIn an era of widening income inequality, it has become standard for CEOs like J.P. Morgan’s Jamie Dimon to signal that they understand the plight of the masses” and IBM CEO Ginni Rometty to focus on the jobs we need to create for former blue-collar workers of America. Both signed the BRT statement.Two of the world’s largest investment managers, BlackRock and Vanguard Group, signed the BRT statement, too. But what corporate governance experts like Elson see in the language is a downgrade of the investor class. Literally.”I think a lot of these guys signed it without thinking about it. … Putting shareholders last and calling them ‘suppliers of capital’ is kind of like calling parents genetic suppliers to existence,” Elson said, using an analogy he said will soon publish in an op-ed he wrote for Directors and Boards, an information source in the field of corporate governance.”How can you tell people who had confidence in you and devoted their hard-earned money to you that they are last in line. It’s not a relationship you should have. Putting them last does not comport to legal standard and is disrespectful in my view,” Elson said.While the Business Roundtable statement refers to all stakeholders, Elson said many investors and directors zeroed in on the placement shareholders received in the list of stakeholders: last.”Shareholders are last in line in a bankruptcy,” Elson said. “If you want to change that and say shareholders are first in line then we can talk about fiduciary duty.” He added, “In a bankruptcy, the first obligation is paying employees. Common shareholders end up with nothing. Everyone else has the ability to protect themselves. Debt holders have contracts. Employees have contracts. Shareholders have nothing but fiduciary duty.”The Business Roundtable published a blog post shortly after its statement was released, headlined “Welcoming the debate,” addressing some of these concerns: “We have not called for, and do not support, radical changes to corporate governance structures, which could have serious unintended consequences. We fully expect that shareholders will continue to hold companies accountable if they fail to generate long-term returns. However, our companies are also challenging themselves to do more.”Accountability to everyone, or no one?Critics say the new Business Roundtable idea is actually very old and already failed once. It resurrects a statement the BRT first published in 1981 on the purpose of a corporation, which they say the trade group ended up revising in 1998 because it did not work, ushering in the era of shareholder primacy.”Good results don’t come from claiming equal accountability to everyone on every decision,” Elson said.As an example, he cited a company that decides to keep a plant open because of its commitment to employees and the community, but which leads to the company ultimately failing and all employees losing their jobs and multiple communities suffering the loss of a major employer. “Lots of bad things happen,” Elson said.”These companies started to get into big trouble when they were responsible to everyone. … It was the stakeholder approach so lauded years ago by corporate America that led to the awful corporate results which in turn sparked the large institutional investors, led by the public pension funds, to press for the dramatic corporate governance reforms of the past twenty-five years.”The Council of Institutional Investors, whose voting members manage $4 trillion in assets at pension funds, labor funds and foundations and endowments, said in a statement that focusing on long-term value generation does not mean putting social goals ahead of shareholders. “It is government, not companies, that should shoulder the responsibility of defining and addressing societal objectives with limited or no connection to long-term shareholder value.”The investor group added, “Accountability to everyone means accountability to no one.”The issue is dividing those within the investment community accustomed to working together: while BlackRock and Vanguard CEOs signed the BRT statement, historically they have worked with the Council on issues of importance to asset managers and investors, and BlackRock and Vanguard officials have served on the Council’s Corporate Governance Advisory Council.The Council’s board of directors includes the chief governance officer from Chevron, whose CEO signed the BRT letter.US firms feel the most short-term pressureShareholder primacy, investors say, does not mean a focus on the short-term.”I am a long-term person,” Elson said. “Anyone who runs a company for the short-term is a fool. The market is efficient in the long run, not the short term. … Directors and shareholders who view prospects quarter-to-quarter are making a mistake.”Nevertheless, a recent CNBC survey of C-suite executives shows that the majority feel pressure to deliver on a quarterly basis for investors.When CNBC asked chief financial officers about support for the Business Roundtable stated goals on the purpose of corporation, 78% said they supported it, according to the CNBC Global CFO Council survey for the third quarter 2019 — 17% opposed it.But when asked over what time frame they feel the most pressure from investors to deliver performance results, near-57% of CFOs said quarterly.”That is no way to run a business for the long-term,” said Jack McCullough, founder and president of the CFO Leadership Council. “How do you make decisions that are in the long-term best interests of the company when most of the pressure comes from the current quarter?”Thirty-percent of CFOs said they feel the most pressure annually. Only 9% said they feel pressure from investors over a two- to three-year period.When asked over what time frame they feel the most pressure from the CEO/board to deliver performance results, only 13% of CFOs said quarterly. But the majority was still one year or less — 43% said they feel the most internal pressure annually.The disconnect between the internal, longer-term focus and the short-term investor pressure is an opportunity, according to Sarah Williamson, CEO of FCLT, a not-for-profit organization focused on improving capital markets and supported by more than 50 global corporations, asset owners and asset managers.”I think most CFOs would find that if they provided their shareholders with a long-term plan similar to what they present to their CEO and board, there would be very little pushback — in fact, shareholders would welcome that strategic foresight.”FCLT is focused on specific ways to focus more investors and companies on the long-term, for starters, ending the practice of quarterly earnings guidance. It says instances of companies issuing quarterly EPS guidance have been steadily declining since 2010 (currently around 27% when looking at the S&P 500).There is a reality: Have a bad quarter and get pounded by the Street.Jack McCulloughCFO Leadership CouncilFCLT spokesman Ross Parker said while the declining quarterly guidance trend is encouraging, the 57% of CFOs in the CNBC survey that said they feel the most pressure from investors quarterly is “fairly high.””We’ve often heard from our corporate members that they hear a great deal from more short-term oriented investors and end up acting on those prompts. Companies hear about hitting or missing consensus earnings targets, read what the sell-side analysts write in their reports, and fear the impact of attention from activists, and their actions follow suit,” Parker said.McCullough said in research he conducted for a book about CFOs there were those who indicated that they felt they alone were balancing the long term with the short term. “There is a reality: Have a bad quarter, and get pounded by the Street.”Corporations already think too highly of their workThe CNBC CFO survey results reveal a potential problem for all stakeholders, whether it is those who believe in the BRT mission statement or the angry shareholder stakeholders: Corporate executive already think very highly of the work they are doing on behalf of everyone.When asked how to rate their companies on delivering value to customers, investing in their employees, supporting communities and dealing with suppliers, almost 100% rated their companies as being, at minimum, “above average.”No CFOs said their companies needed improvement in delivering value to customers, supporting communities or dealing with suppliers.The results were similar when asked about delivering long-term value to shareholders, with 96% of respondents saying they were, at minimum, above average.In fact, across all of the questions asking corporations to rate themselves, the most popular response was not “above average” but “best in class.” (61% said they were best in class at generating long-term returns for shareholders.)”While the confidence is admirable, recruiting and retention – particularly of the highly-coveted young employees – is one of the biggest challenges employers face. … Would you want to work for a company that does not think it needs to improve how it invests in employees? Me, either,” McCullough said.He added: “Would you invest in a company if you knew the CEO felt this? Remember the Andy Grove quote: ‘Success breeds complacency. Complacency breeds failure. Only the paranoid survive.’ Seems like we need to relearn this lesson.”Elson dismissed these results as revealing anything telling about the way C-suites think and act. He said most CFOs would not be inclined to say they disapproved of the BRT statement that their CEO had just signed, or rate their companies poorly on any metric that could become evidence in a shareholder lawsuit. And then there is their executive compensation to think about. “If they suggested they need to do something more, it suggests a deficiency in conduct, and anyone in that position wants their 110% percent bonus.””This is why we don’t let students grade their own exams. That’s why you have boards,” Elson said, though at a larger level the “why” of the corporate board seems to be something that today he is less sure about.

Source link