BUSINESS NEWS

30 years of market history says tech stocks will end 2019 much higher

[ad_1]

Apple came under pressure earlier this week, and as the second-biggest stock by weight in the S&P 500, that weighed on U.S. equities. Apple is one of five “big tech” companies among the S&P 500’s top 10 holdings: Microsoft (No. 1); Amazon (No. 3); Facebook (No. 4); and Alphabet are the others. Apple also is a member of the Dow Jones Industrial Average, which posted its third-straight losing day Tuesday.

Information technology stocks comprise roughly 21.5% of the S&P 500, and the group has led the way up for the index this year.

The S&P 500 logged its best first six months since 1997, jumping more than 17%. Information technology was the best-performing U.S. sector, up 26% year-to-date through the end of June. That was the tech sector’s best first half since 1998.

All eyes are on the Federal Reserve and whether it will cut rates later this month, as is widely expected, or if the central bank thinks the economy is strong enough to maintain current economic policy, especially after the strong national jobs numbers reported last Friday. Fed Chair Jerome Powell is scheduled to testify in front of the House Financial Services Committee on Wednesday.

Dow futures started down on Wednesday morning but turned to a pre-market gain after Powell’s prepared remarks ahead of the testimony were released. The market read his statement — about a Fed that will “act as appropriate” to sustain expansion as “crosscurrents” are weighing on the economic outlook — as a sign that a July rate cut is coming.

Stocks have been hot as expectations for lower rates boosted the market through the month of June and to a record high last week. But looking to market history for potential catalysts instead of the Fed, there is reason to think tech stocks and the broader market can maintain their momentum through the second half of 2019.

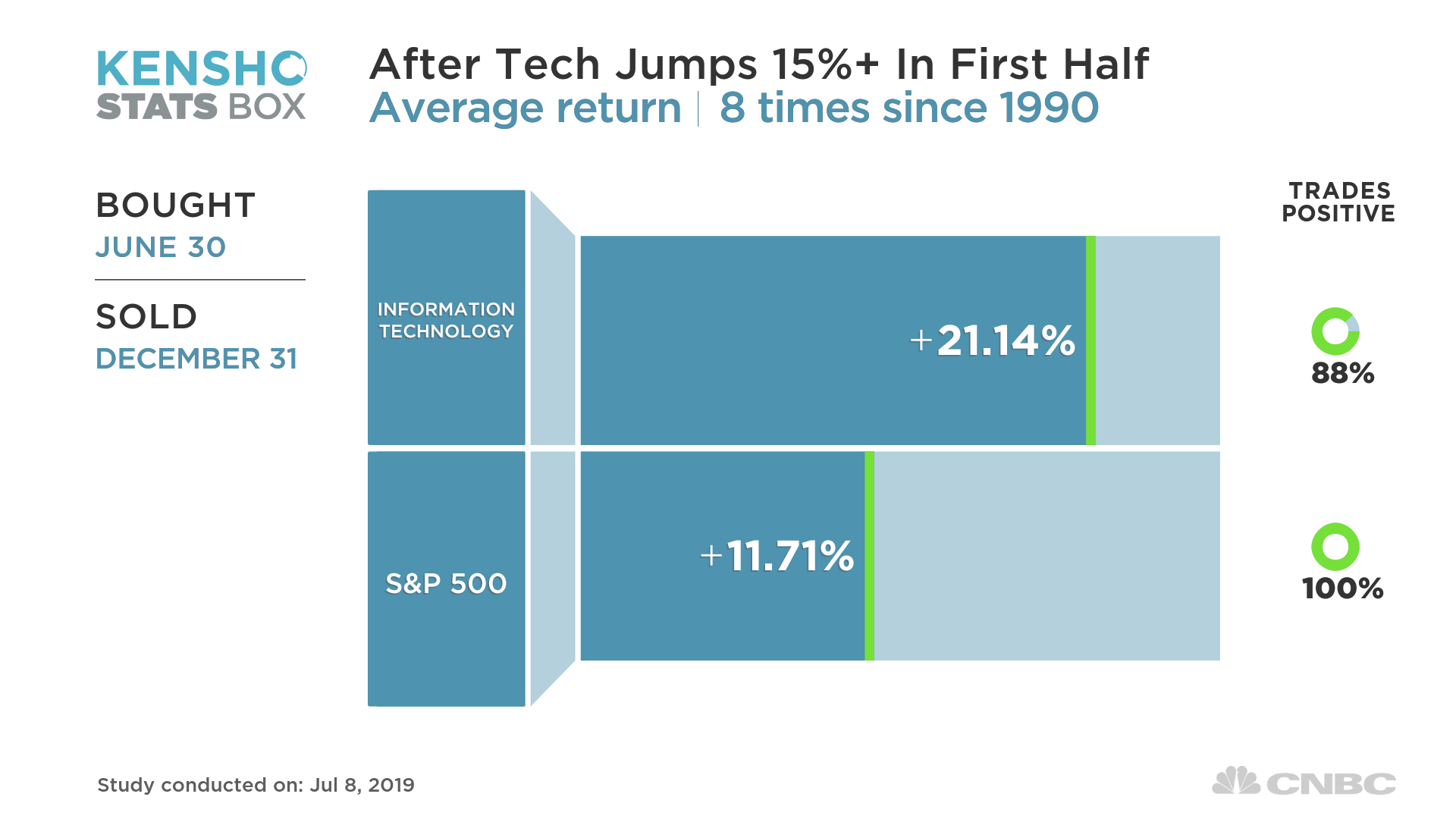

Since 1990, the tech sector has had similar gains of at least 15% in the first half of the year on eight other occasions. Following those moves, the tech sector traded positively 88% of the time in the second half of the year, according to a CNBC analysis of Kensho, a machine learning tool used by Wall Street banks and hedge funds to identify potential trades from market history. The S&P 500 information technology sector logged an average return of 21% during those second-half periods; the broader market notched a gain of roughly half the tech run, but traded positive 100% of the time.

[ad_2]

Source link